Problem

Back in 2013-14, when our organic user acquisition was growing, there was a mismatch in the customer expectations and what we were offering.

Our customers were:

- Expecting us to bring them leads. According to them, Instamojo was a marketplace like Flipkart & Amazon (which wasn't the case, we were offering e-commerce & payment tools)

- Confused between the products we offered—which one was right for them?

Insights

We turned to those customers who understood Instamojo.

At that time, Offers was our primary product— merchants could create an Offer, share it with their customers or list it on their Online Store.

Data analysis revealed that our most successful customers were:

- Using these Offers like a simple link: with a title and amount

- Not using any other feature as much

After talking to these customers, we learned that they:

- Share links to collect payments. Everything else was optional.

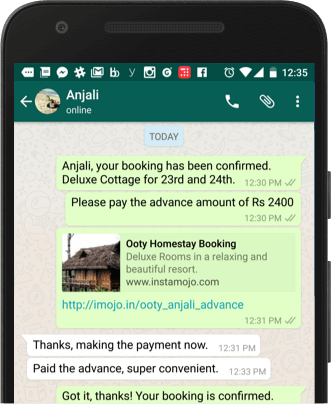

- Use these links to close sales over WhatsApp, Calls, SMS, social media, etc.

Solution

MSME's are diverse and their behaviours, requirements, and workflows are fragmented. The business (Instamojo) wanted to de-risk and offer a variety of products to address the problems.

The alternative was:

Keep the experience simple and no B.S.

With our existing products, we were offering too many features. Our customers kept reminding us, "everything else is optional".

Customers were using links to collect payments.

The pain was payment collection when closing the sale and giving the customer a choice in payment instruments.

The solution was Payment Links.

Payment Links are simple and quick. You just enter an amount and a purpose, and it's done! Watch Video

This clarity achieved from UX research changed how we think of our customers, and vice-versa.

Results

Customers loved Payment Links from day one. We had never seen this speed of adoption for any product before Payment Links:

Within 80 days, over 30% of Instamojo's GMV was coming from Payment Links.

This is what our customers had to say:

"I've been using Instamojo since your early days. [You] finally hit clarity, kudos to the team."

"You had a paradigm shift!"

Long-term Cost Reduction

Now when a business signs up on Instamojo they see the option to Create Payment Link upfront. The functional name of the product means we don't have to explain anything to the customer.

Over 80% of new activations happen without high-touch sales.

Product-Market Fit

Payment Links aren't a technically challenging product. In fact, with an in-house engineering team, it'd take you less than a day to create this.

However, in the MSME market, there is often lack of technical know-how and bandwidth. That's why Payment Links work well for MSMEs and fail in other markets.

The long-tail market segment where Payment Links fulfill customer needs.

The long-tail market segment where Payment Links fulfill customer needs.Today, you will see Payment Links everywhere in the Indian ecosystem. It all started with a simple UX insight.

You can read more about the making of Payment Links here.

Team

- UX Research & Lead Designer — Sidharth

- Product Manager — Dalan Mendonca